Executive Summary

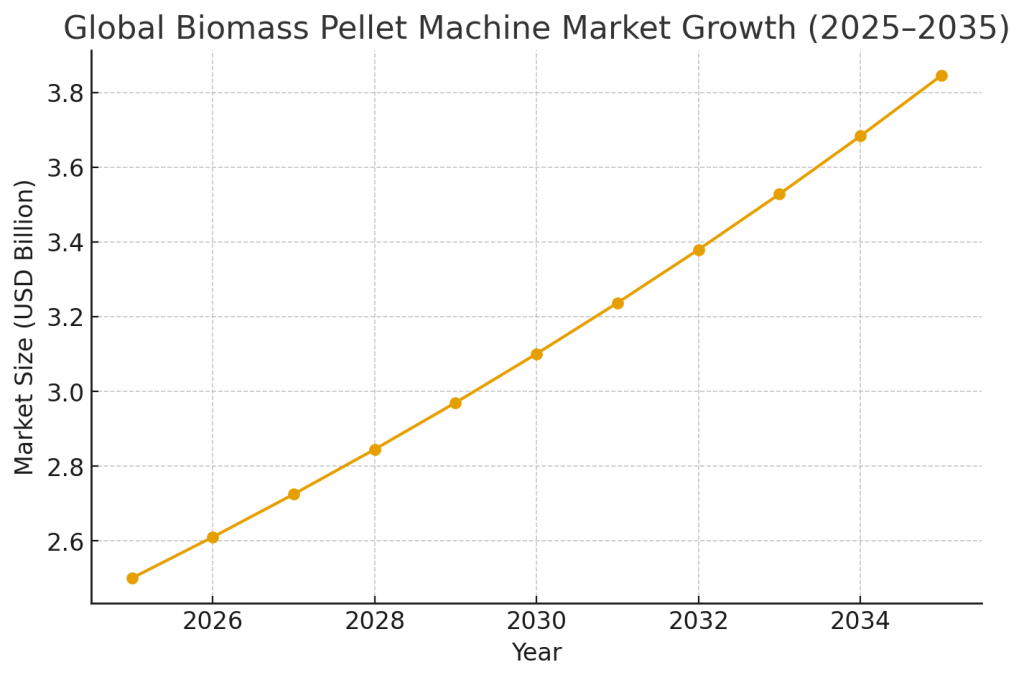

The global biomass pellet machine manufacturing industry is experiencing unprecedented growth, driven by increasing demand for renewable energy solutions and stringent environmental regulations. The biomass pellets market, which directly drives demand for pellet manufacturing equipment, is projected to reach USD 23.6 billion by 2035, with the pellet machine market specifically forecasted to grow from USD 2.5 billion in 2025 to USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4%.

This report analyzes key market trends, competitive landscape, regional dynamics, and future opportunities in the biomass pellet machine manufacturing sector, providing strategic insights for industry stakeholders.

1. Market Size and Growth Analysis

1.1 Global Market Valuation

The biomass pellet manufacturing equipment market is experiencing robust expansion across multiple measurement metrics:

- Pellet Machine Market: USD 2.5 billion (2025) → USD 3.8 billion (2035), CAGR: 4.4%

- Underlying Biomass Pellets Market: USD 11.9 billion (2024) → USD 17.9 billion (2030), CAGR: 6.7%

- Alternative Market Projections: USD 9.60 billion (2024) with CAGR of 6.04% through forecast period

1.2 Machine Type Distribution

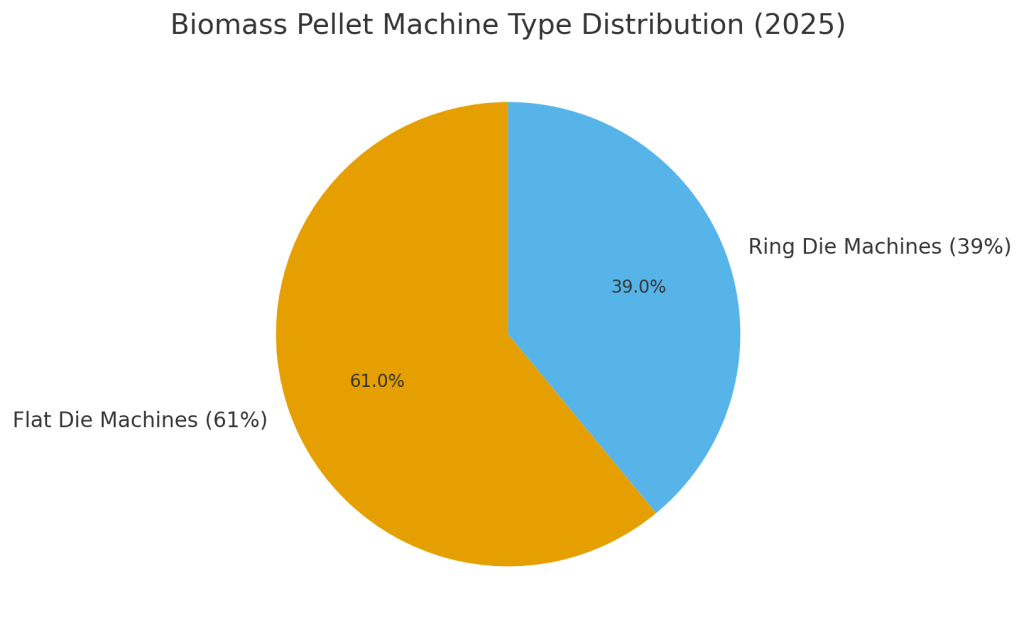

Equipment demand is segmented by machine configuration:

- Flat Die Pellet Machines: 61% market share dominance

- Ring Die Pellet Machines: 39% market share

- Application Focus: Biomass fuel sector accounts for 64% of end-use applications

1.3 Growth Drivers

Primary factors propelling market expansion include:

- Renewable Energy Mandates: Government policies promoting clean energy adoption

- Industrial Decarbonization: Manufacturing sector transition to sustainable fuel sources

- Residential Heating Demand: Growing consumer preference for biomass heating solutions

- Agricultural Waste Utilization: Increased focus on converting agricultural residues into valuable fuel products

2. Regional Market Analysis

2.1 North America

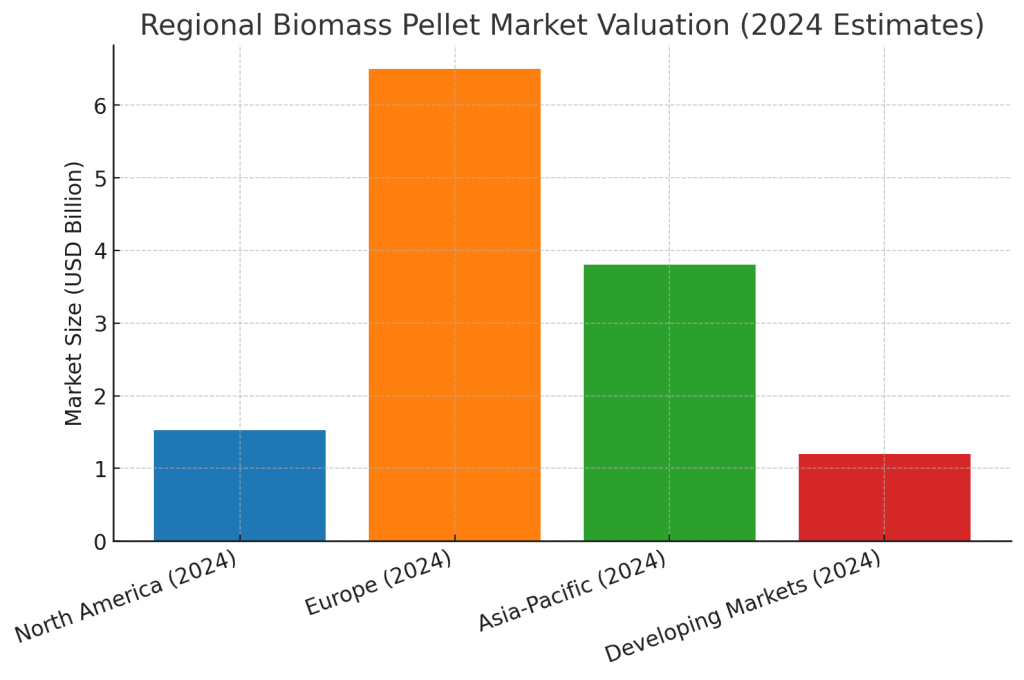

The United States represents a significant consumer market, with biomass pellet consumption expected to grow by 5.1% year-over-year in 2024, reaching a market valuation of USD 1.53 billion. Key characteristics include:

- Market Position: Major importer and consumer of biomass pellets

- Manufacturing Base: Strong domestic pellet machine production capabilities

- Policy Support: Federal and state-level renewable energy incentives

2.2 Europe

European markets lead in biomass adoption for heating and power generation:

- Regulatory Framework: EU Renewable Energy Directive driving demand

- Key Markets: Germany, United Kingdom, and Scandinavian countries

- Technology Leadership: Advanced pellet production technologies and efficiency standards

2.3 Asia-Pacific

Emerging as the fastest-growing region for biomass pellet machine demand:

- China: Largest manufacturing base for pellet equipment

- India: Rapidly expanding domestic market with local manufacturers

- Southeast Asia: Growing agricultural waste processing initiatives

2.4 Developing Markets

Middle East, Africa, and Latin America showing increasing interest:

- Agricultural Integration: Utilization of crop residues for pellet production

- Energy Security: Biomass as alternative to imported fossil fuels

- Economic Development: Local manufacturing job creation opportunities

3. Competitive Landscape and Key Market Players

3.1 Global Equipment Manufacturers

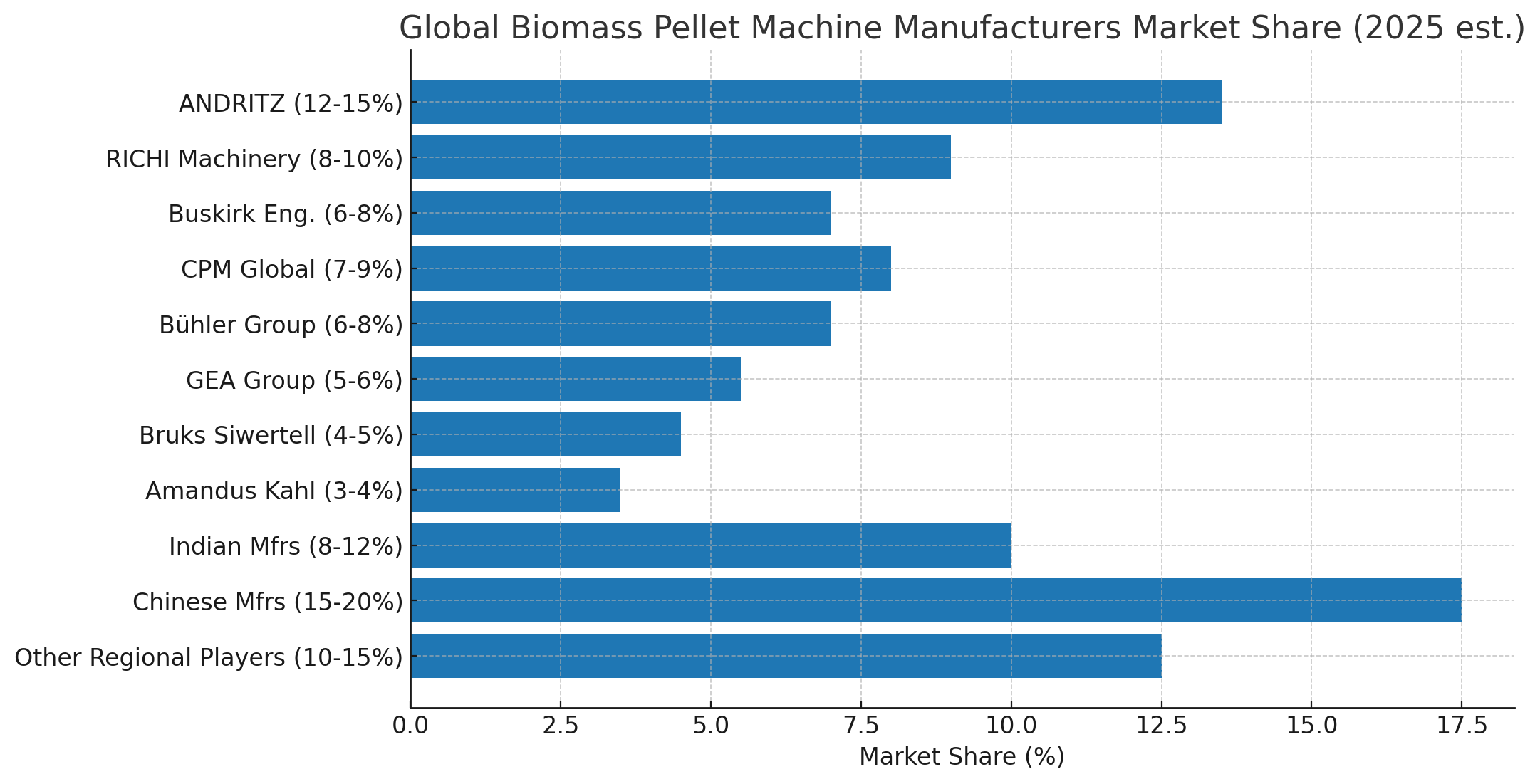

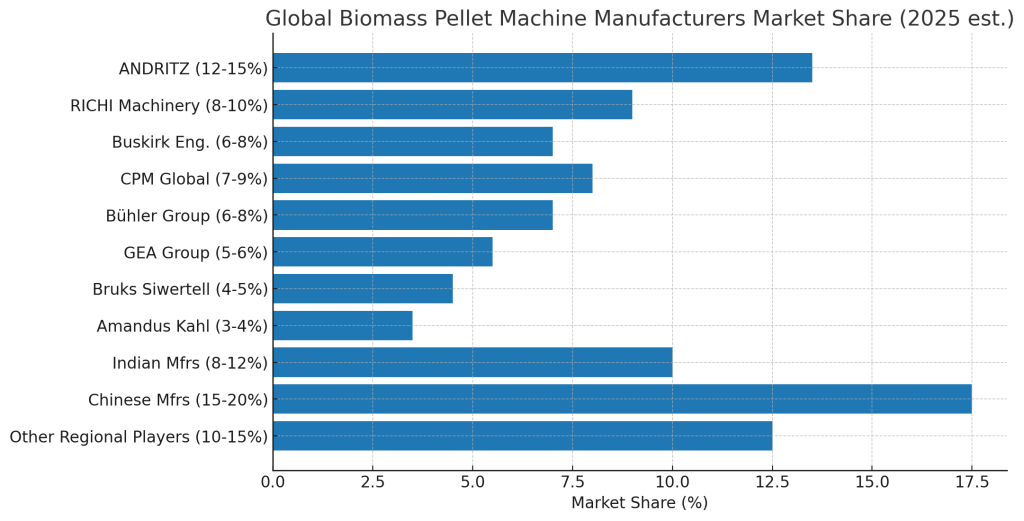

Tier 1 International Players:

- ANDRITZ Group (~12-15% market share): Leading global provider of complete biomass pelleting solutions with decades of experience across wood, feed, and biomass industries. Known for robust, efficient, and user-friendly designs with comprehensive service quality leadership.

- RICHI Machinery (~8-10% market share): Major international manufacturer specializing in biomass pellet production equipment and complete pelleting plant solutions, with strong presence in Asian and emerging markets.

- Buskirk Engineering (~6-8% market share): Leading manufacturer of custom-designed flat die pellet mills in the United States, specializing in turnkey system solutions with emphasis on customer satisfaction and sustainability focus.

- CPM Global (~7-9% market share): High-precision pellet mill provider serving animal feed, oilseed, and biomass processing industries with stringent quality requirements and advanced processing capabilities.

- Bühler Group (~6-8% market share): Global technology leader offering scalable pellet machine solutions from small enterprises to large industrial complexes, with expertise in pelleting diverse materials and comprehensive post-pelleting applications.

Tier 2 Regional Leaders:

- GEA Group (~5-6% market share): Offers both stand-alone and integrated solutions with customizable and energy-efficient pellet mills, serving multiple industries with focus on sustainability and production efficiency.

- Bruks Siwertell (~4-5% market share): Specializes in heavy-duty machines for biofuel, panel, sawmill, and pulp industries, known for equipment that withstands harsh industrial environments while delivering exceptional pellet quality.

- Amandus Kahl (~3-4% market share): German manufacturer of pelletizers serving various industries with wide range of pelletizing technology equipment, focusing on capacity, safety, and highest quality standards.

- Indian Manufacturers (~8-12% combined market share):

- Gattuwala Energy: Leading domestic supplier

- Satyajit Renewable Engineering: Top quality biomass pellet machines

- Keyul Enterprise: Established biomass pellet making machine manufacturer

- Chinese Manufacturers (~15-20% combined market share): Cost-competitive solutions for global markets with significant manufacturing capacity and export presence.

- Other Regional Players (~10-15% combined market share): Local manufacturers serving specific geographic markets including La Meccanica (Italy), Promill-Stolz (France), and various North American suppliers.

3.2 Market Concentration

The industry exhibits moderate concentration with:

- Market Leadership: No single dominant player controlling majority market share

- Regional Specialization: Strong local players in key geographic markets

- Technology Differentiation: Companies competing on efficiency, reliability, and service capabilities

3.3 Competitive Strategies

Key competitive approaches include:

- Technology Innovation: Advanced automation and energy-efficient designs

- Complete Solutions: Turnkey plant installations rather than individual equipment sales

- After-Sales Service: Comprehensive maintenance and support packages

- Customization: Tailored solutions for specific biomass feedstock types

4. Technology Trends and Innovations

4.1 Equipment Efficiency Improvements

- Energy Optimization: Reduced power consumption per ton of pellet production

- Automation Integration: Smart monitoring and control systems

- Wear Resistance: Enhanced die and roller materials for extended operational life

4.2 Feedstock Diversification

Modern pellet machines accommodate broader range of biomass materials:

- Traditional: Wood chips, sawdust, wood shavings

- Agricultural: Straw, corn stalks, rice husks

- Alternative: Coconut shells, palm kernel shells, energy crops

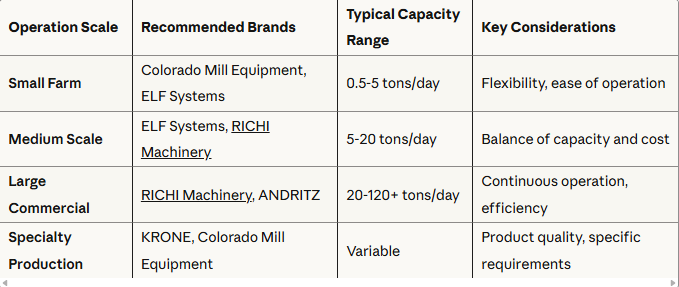

4.3 Production Scale Optimization

- Small-Scale Systems: 1-5 tons/hour for distributed production

- Industrial Systems: 20+ tons/hour for large-scale operations

- Modular Designs: Scalable production capacity based on demand growth

5. Application Sector Analysis

5.1 Residential Heating Sector

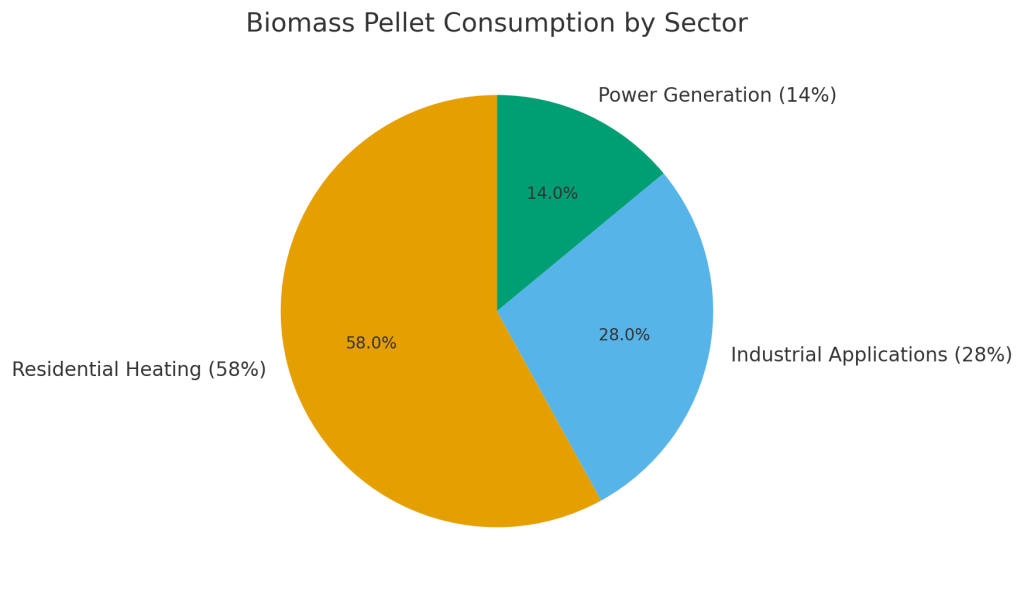

Market Share: 58% of total biomass pellet consumption

- Growth Drivers: Home heating cost reduction, environmental consciousness

- Geographic Focus: Northern European countries, Canada, Northern United States

- Equipment Demand: Small to medium-scale pellet production equipment

5.2 Industrial Applications

Market Share: 28% of total consumption

- Primary Uses: Industrial boilers, manufacturing process heat

- Growth Potential: Industrial decarbonization initiatives

- Equipment Requirements: High-capacity, continuous operation systems

5.3 Power Generation

Market Share: 14% of total consumption

- Applications: Biomass power plants, co-firing with coal

- Regional Leaders: Europe and North America

- Equipment Specifications: Large-scale, high-reliability systems

6. Market Challenges and Opportunities

6.1 Key Challenges

- Raw Material Supply: Consistent feedstock availability and quality

- Competition with Food: Agricultural residue competing uses

- Transportation Costs: Logistics of biomass feedstock delivery

- Quality Standards: Meeting international pellet quality specifications

- Initial Investment: High capital requirements for complete pellet production facilities

6.2 Growth Opportunities

- Emerging Markets: Developing countries with abundant agricultural waste

- Technology Advancement: AI-driven optimization and predictive maintenance

- Sustainability Focus: Corporate carbon reduction commitments

- Government Support: Continued policy backing for renewable energy

- Circular Economy: Waste-to-energy conversion initiatives

7. Future Market Trends (2025-2035)

7.1 Market Evolution Projections

- Continued Growth: Sustained 4-7% annual growth across all major markets

- Technology Convergence: Integration of IoT, AI, and advanced materials

- Market Maturation: Consolidation among smaller manufacturers

- Regional Shifts: Growing importance of Asia-Pacific and developing markets

7.2 Emerging Technologies

- Smart Manufacturing: IoT-enabled pellet production monitoring

- Advanced Materials: Improved die materials and surface treatments

- Process Integration: Combined drying, pelletizing, and cooling systems

- Energy Recovery: Heat recovery systems for improved overall efficiency

7.3 Regulatory Developments

- Sustainability Standards: Stricter environmental certification requirements

- Quality Specifications: Enhanced international pellet quality standards

- Carbon Pricing: Economic incentives for low-carbon fuel production

- Trade Policies: International agreements facilitating biomass trade

8. Strategic Recommendations

8.1 For Equipment Manufacturers

- Technology Investment: Focus on automation and efficiency improvements

- Geographic Expansion: Establish presence in high-growth developing markets

- Service Integration: Develop comprehensive after-sales support capabilities

- Partnership Strategy: Collaborate with feedstock suppliers and end-users

8.2 For Market Entrants

- Niche Specialization: Focus on specific feedstock types or applications

- Regional Focus: Establish strong position in specific geographic markets

- Technology Licensing: Partner with established technology providers

- Value Chain Integration: Consider vertical integration opportunities

8.3 For Industry Stakeholders

- Supply Chain Development: Invest in reliable feedstock supply networks

- Quality Assurance: Implement comprehensive quality control systems

- Sustainability Documentation: Establish clear sustainability credentials

- Market Intelligence: Maintain awareness of regulatory and technology changes

Conclusion

The global biomass pellet machine manufacturing industry is positioned for sustained growth through 2035, driven by renewable energy adoption, environmental regulations, and technological advancement. While challenges exist around feedstock supply and initial investment requirements, the fundamental market drivers remain strong.

Success in this evolving market will require manufacturers to balance technological innovation with cost competitiveness, while developing comprehensive solutions that address the complete value chain from feedstock processing to final pellet production. Companies that can effectively serve both established markets in North America and Europe while capturing growth opportunities in developing regions will be best positioned for long-term success.

The industry’s future depends on continued technological advancement, supportive policy frameworks, and the broader global transition toward sustainable energy sources. As these trends continue, biomass pellet machine manufacturers have significant opportunities to contribute to global decarbonization efforts while building profitable, sustainable businesses.

Report compiled based on market research data from multiple industry sources, including Future Market Insights, Straits Research, Market Reports World, and industry publications. Data represents best available information as of September 2025.